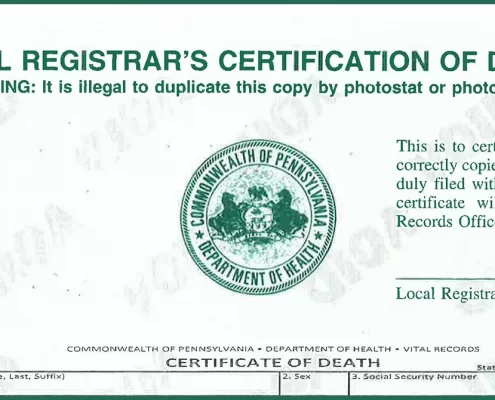

Why You Can’t Photocopy Pennsylvania Death Certificates

Estate Administration, Wills & Estates

When a loved one passes away, one of the first steps in the estate administration process is the issuance of death certificates. Death certificates are required for many things, including opening probate and obtaining a short certificate.…

Cornerstone Law Firm in the Greater Reading Merchandiser

Business Law, Landlord/Tenant, Lawsuit, Personal Injury, Property, Updates, Wills & Estates

Cornerstone Law Firm is honored to serve the Berks County, Pennsylvania and beyond. We're happy to solve your legal problems, even through the uncertainty and stress of the current coronavirus (COVID-19).

In this month's Greater Reading…

What Do I Do with the Will When A Loved One Passes Away?

Estate Administration, Probate, Wills & Estates

When you experience a death in the family, the details of wrapping up the loved one’s legal affairs can seem overwhelming. One of the first questions that many people ask after the death of a loved one is, “What do I do with the Will?”

"What…

3 Reasons You Need a Will

Berks County, Wills & EstatesEveryone needs a will. Every year, individuals die without wills, and their families deal with a great deal of unnecessary headache, stress and sorrow because of the unpreparedness of the family member who passed away. But despite the fact that…