https://cornerstonelaw.us/wp-content/uploads/2024/05/10.5-Notice-Individual-Example-scaled.jpg

2560

1978

Cornerstone Law

https://cornerstonelaw.us/wp-content/uploads/2017/06/cornerstone-law-black-300x109.png

Cornerstone Law2024-06-10 12:22:162025-07-01 11:59:39Completing Certification of Notices (10.5s) in the Estate Process

https://cornerstonelaw.us/wp-content/uploads/2024/05/10.5-Notice-Individual-Example-scaled.jpg

2560

1978

Cornerstone Law

https://cornerstonelaw.us/wp-content/uploads/2017/06/cornerstone-law-black-300x109.png

Cornerstone Law2024-06-10 12:22:162025-07-01 11:59:39Completing Certification of Notices (10.5s) in the Estate Process

When is the Reading of the Will?

Estate Administration, Wills & EstatesThe scene opens in an oak-paneled conference room, as shafts of light descend through the large windows in the lawyer’s office onto the pages of an ancient, creased will. The grumpy lawyer slowly begins with some preamble when he is interrupted…

Am I Responsible for My Parent's Debts?

Estate Administration, Wills & EstatesWhen a parent dies, the adult children often ask if they are responsible in any way for the debt that is left behind. The quick and easy answer is, no, you are generally not responsible for the debts of your loved one who passed away. There…

What can I do with a short certificate?

Estate Administration, Probate, Wills & EstatesWhen you obtain a short certificate for an estate, what does it empower you to do? The short certificate is the document granted by the Register of Wills in a county to the Executor of an estate. The Executor, having named and granted these…

The Right of Sepulchre

Estate Administration, Wills & Estates, Wrongful DeathWhen a loved one passes away, there can be disputes regarding how to treat and dispose of the body. Ideally, the decedent would have included clear funeral instructions in his or her last will and testament. In some cases, those wishes might…

Guardianship: When Loved Ones Cannot Care for Themselves

Estate AdministrationWhen someone you love is incapable of self-care physically or financially, a guardianship is often the best approach. In this article we will discuss the pros and cons of pursing guardianship, as well as what you will need to present to a court…

Reaching Family Settlement Agreements in Estates

Estate Administration, Probate, PropertyWhen a family member passes away, many factors can combine to create conflict over how to resolve the estate. Oral promises made by the decedent while alive, or a confusing portion of a will, or an apparent change in circumstances since the…

Does my College Aged Student Need a Power of Attorney?

Estate AdministrationAs fall arrives and students move off to college, parents often ask whether their student needs a power of attorney (POA) or medical power of attorney form. Power of attorney forms allow an Agent (Parent) to make financial decisions on behalf…

What is a Power of Attorney in Pennsylvania?

Custody, Estate Administration, Wills & EstatesPower of Attorney is a document granting one person the ability to make decisions regarding property and possessions on behalf of another. The power of attorney document (POA) is named this because the agent can act in many ways as an attorney…

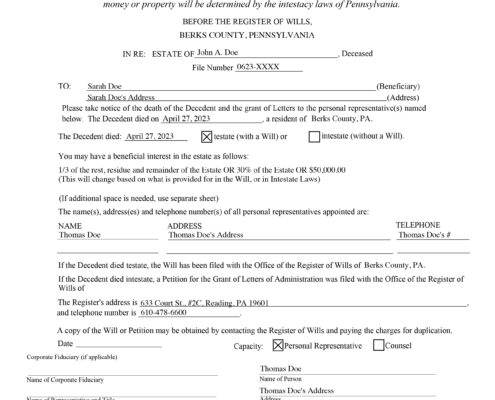

Giving Notice to Estate Beneficiaries

Estate Administration, Wills & EstatesBeneficiaries of an estate are entitled to notice when the estate is being probated, and it’s the executor’s job to send the notice. Today, we’ll give a brief overview on how to fulfill this part of the estate process.

Giving notice…

Opening an Estate in Schuylkill County

Estate Administration, ProbateWhen someone you love has passed away, you’re confronted with many difficult decisions, and an estate process that can feel very complicated. If the person that you love passed away while living in Schuylkill County, here are the first three…

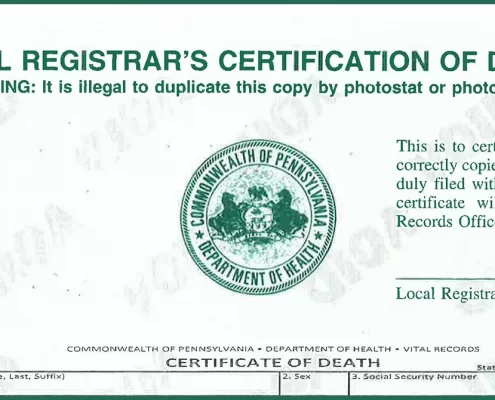

Why You Can’t Photocopy Pennsylvania Death Certificates

Estate Administration, Wills & Estates

When a loved one passes away, one of the first steps in the estate administration process is the issuance of death certificates. Death certificates are required for many things, including opening probate and obtaining a short certificate.…